Hidden Insurance Gaps That Threaten Your Wealth

How can a hidden gap in your homeowner’s or auto insurance turn into a massive financial sinkhole that threatens your retirement nest egg? Dr. Chris Mullis, a CERTIFIED FINANCIAL PLANNER™ and former rocket scientist, guides you through a robust insurance review to protect your lifestyle and assets. Plus, we answer a crucial question: is your hard-earned Social Security benefit truly tax-free, or is the IRS planning a surprise? And we take a look at the discovery of the oldest exploding star ever seen, and how it’s rewriting the history of the early universe. Tune in to boost your financial confidence and expand your universe!

Retirement Big Picture

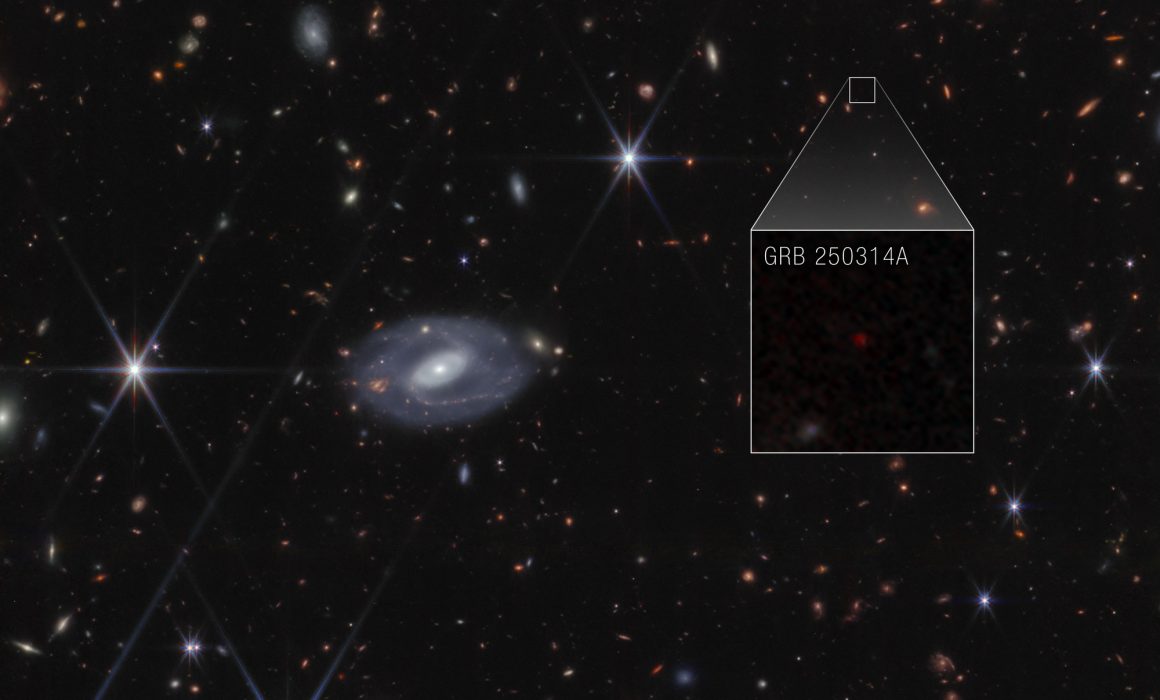

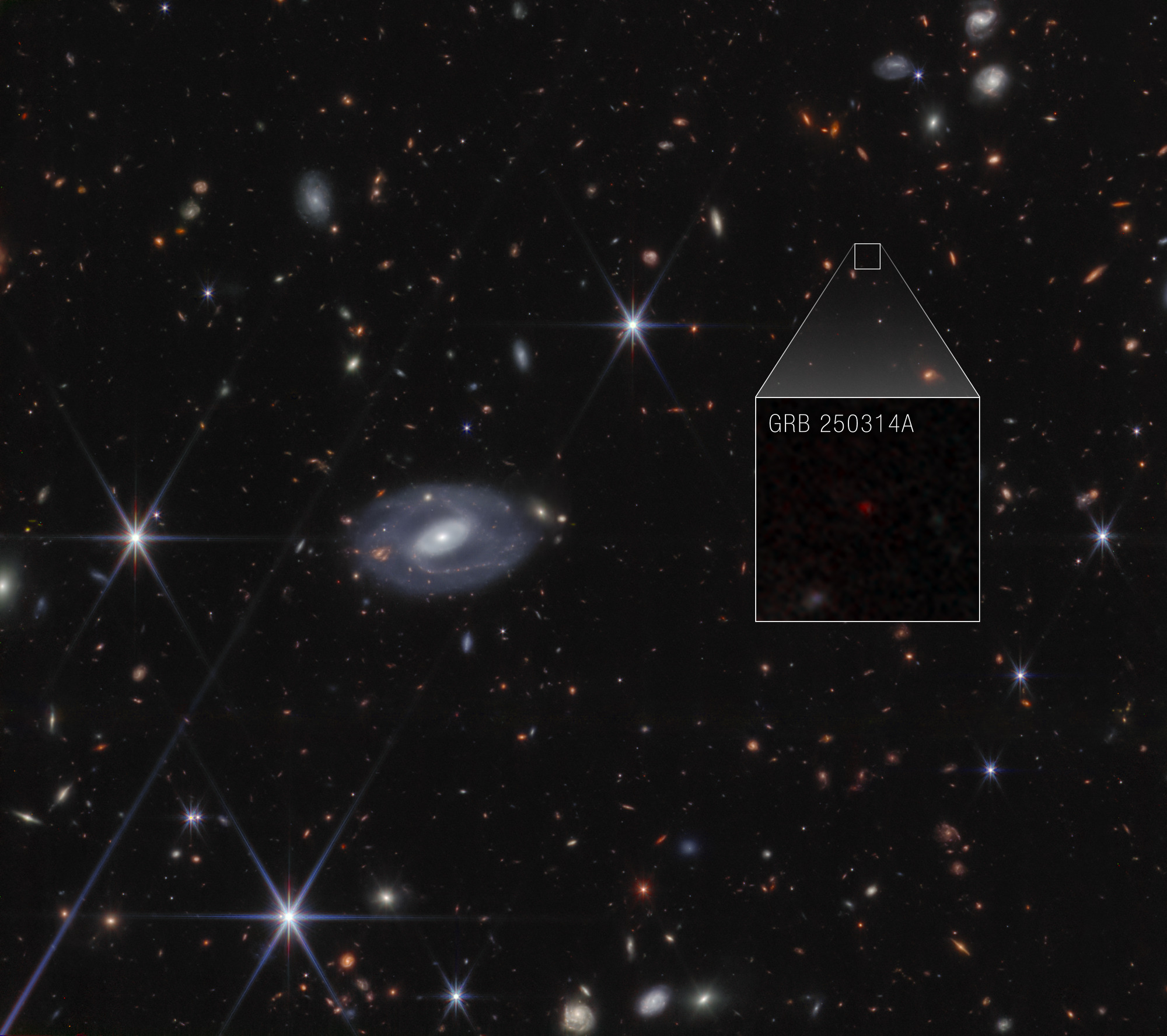

We blast off for a quick trip back to astrophysics to marvel at the latest from the James Webb Space Telescope. JWST discovered GRB 250314A, a supernova that exploded when the universe was only 730 million years old, shattering the record for the oldest observed exploding star. The shocking part is that this ancient explosion looked remarkably similar to modern-day supernovas, proving that the underlying “cosmic plan” settled into pattern much earlier than scientists previously thought.

Sign Up for The Launch

The Launch is a weekly email from Dr. Chris and his team. It’s full of retirement tips, news, listener questions & more, straight from us to your inbox. Get smarter about retirement in just 5 minutes every week. Let’s go!

Episode Resources

- …

…

Episode Transcript

Introduction

Dr. Chris Mullis, PhD, CFP®: How can a hidden gap in your insurance plans become a massive financial sinkhole? The Social Security Administration put out a press release this summer indicating new tax law essentially ends taxes on social security. Is that true? And how did the Web Space telescope just break the cosmic clock?

Are you ready?

Dr. Chris Mullis, PhD, CFP®: Welcome back to Retirement Isn’t Rocket Science. I’m your host, Dr. Chris Mullis, a certified financial planner and former rocket scientist. Our core mission is to show you how to lower your taxes. Strengthen your portfolio and spend more with confidence so you can make your retirement even better.

Along the way, we’re gonna make sure all the dimensions of your money universe are beautiful, effective, and resilient. And of course, we’re gonna have some fun and learn cool stuff by exploring the most unique places in our cosmos.

Dr. Chris Mullis, PhD, CFP®: In today’s episode, we’ll show you how to inspect and repair the shield that protects your family and your lifestyle. You’ve been paying into social security your entire life, so when you finally start collecting is that money truly tax free? And we take a look at the discovery, the oldest exploding star ever seen, and how it’s rewriting the history of the early universe. Now let’s dive in.

Retirement Briefing Room

Dr. Chris Mullis, PhD, CFP®: Welcome to the Retirement Briefing Room. This is where we huddle up to take a close look at important aspects of your financial life, spotlight, important pathways of success, and think about how to integrate these into your plans to make your retirement even better. We’ve got something special for you. In today’s episode I own a financial planning firm that provides full service wealth management to people approaching or in retirement.

It’s been my honor to walk this journey with thoughtful people to and through retirement for 20 years. Today I’m gonna share with you. Some Of the things that we reviewed of our clients during our recent fall planning meetings. We’re gonna focus today’s conversation on one major theme, protecting your lifestyle.

But before we go deep there, I thought it would be helpful to get an overview about what our ongoing planning meetings look like for established clients.

First and always first, we discuss our client’s questions and concerns, whatever is top of mind for them. We’re gonna talk about those items at the beginning of our meeting for as long as it takes. Then we’re gonna take a look at the big picture. Before getting granular and into tactics in the fall, we reviewed the eight key principles for building and maintaining an amazing retirement for financial and for non-financial.

Next, we look at our client’s investments. This is the rocket fuel of their retirement, and if our clients are living off their portfolio, we’re gonna examine their retirement income guardrails. This is the strategy. The withdrawal strategy that we use to maximize their retirement spending without them ever running out of money

next comes tax planning, a standing feature of both our spring and fall meetings. In the fall, we finalize their tax forecast for the year. This is important because in retirement we have a lot of options on how to source income. Hence, things are more hands-on in terms of calculating your tax bill and making sure it gets paid and having this robust tax forecast is a key input to the multi-year tax strategies that we run for our clients

there was a lot to talk about due to the multitude of changes thanks to the one big beautiful bill act that passed in July that we talked about in episode number three with its far reaching impacts across all of our tax planning. The final topic of our fall planning meeting was around protecting our clients’ lifestyle, specifically conducting a robust review of their property and casualty insurance. Think home, auto and umbrella policies.

Let’s step back and define some terms. Property and casualty is a name that bundles two distinct, yet commonly sold types of coverage. The first part is the P property insurance. That’s the P and p and C. This covers the things you own, your possessions and structures. What it does is pays for repairs. Rebuild or replace your property if it is damage, destroyed or stolen due to a covered event. The jargon is a peril. Examples of covered perils include fire theft, vandalism, smoke, wind, storms, and hail.

The focus here is protecting your financial investment in your stuff. The second part is casualty insurance. That’s the C and p. And C. This covers your legal liability to others, your financial responsibility for causing harm. So what does it do? It pays for the damages, medical bills, and legal defense costs if you are found legally responsible for an accident that causes injuries to another person or damage to their property.

So the focus here is protecting your assets from a lawsuit or a claim filed by a third party.

So as I said before, the typical types of policies that we’re looking at here in terms of property and casualty are your homeowner’s policy, your auto policy , and your personal umbrella policy. That last item, the umbrella, is probably the one sometimes people aren’t quite familiar with , so let’s talk about that for a moment.

Umbrella insurance is an extra layer of liability coverage that goes above and beyond the limits of your existing primary policies, such as your homeowners or auto insurance. It’s designed to protect your assets, think your home, your savings, and your future earnings from being taken to satisfy a massive judgment or settlement in a lawsuit.

Now that we’ve got those definitions addressed, I wanna share an important clarification.

I don’t sell insurance. My firm does not sell insurance. As a fee only financial advisor, the only thing that I sell is pure advice. There are no products. That said, as a full service wealth advisor, we manage all aspects of our clients’ financial lives, including their investments, their taxes, their income, their estate, and their insurance planning.

So we make sure everything is dialed in safe and fully optimized for their wellbeing.

We’re going to end today’s conversation about insurance planning with Alyssa’s specific shortcomings and opportunities that we discover in our client’s own financial space. These are important things that you should check in your own insurance our clients are smart and thoughtful people, so their finances are not sloppy or, are not unintentional .

So the fact that we can find shortcomings and opportunities in these very with IT folks is a reminder that it happens everywhere because. There’s some intrinsic complexity to all of this that again, we’re trying to simplify so that your insurance plans can be even better. So before we look at those specific shortcomings and opportunities, I wanna set the stage a little bit more by discussing some of the most common planning pitfalls with property and casualty insurance. The first kind of misunderstandings that we commonly see are just. Not understanding the basics. You know, things like, hey, insurance covers all types of damage. Right? In reality, that insurance policy usually covers only specific things that happens, or specific payrolls.

Another common misconception, Hey, my umbrella policy covers anything. My other policies don’t, we just talked about how umbrella policies cover excess liability, not physical damage or personal property or business related claims. So there’s different slots for different things.

A third common thing we hear is, Hey, I’ll be made whole. The insurance will rebuild my house or replace my car fully. And the reality is the coverage may be limited to a replacement or a rebuild cost and policy caps. A fourth thing in this category

we hear, Hey, once I buy a policy, I’m protected. I don’t need to think about it anymore, and that’s definitely not true. Insurance needs change with life events, and if policies aren’t updated, you can be underinsured by accident.

A second kind of pitfall is choosing policies based on price. That is problematic for a couple reasons. First, low premiums often mean limited coverage. Also cheap policies can create very expensive gaps. And then the reality is not all insurance carriers are created equal, so let’s not optimized on lowest price , let’s optimized on the value and the comprehensive nature of the coverage. Their third kind of misunderstanding we very often see is titling and ownership mismatches. When an asset is held inside a trust or a limited liability company, an LLC, that extra entity that trust or the LLC needs to be listed as an insured entity. In addition to the personal name on the policy, this is super important because coverage can be denied due to a lack of insured interest.

And this goes for, real estate on homeowners or landlord policies. And it also should be, true for your umbrella policy. The trust or the LLCs need to be listed on the umbrella as well.

The fourth kind of common pitfall we see is simply outdated coverage. You may have made a beautiful renovation to your home, but you haven’t shared it with your insurer. You might be thinking, you’re saving some money by, not sharing that, but you’re taking a huge risk because of being underinsured on your dwelling.

So as you improve your resonance, it’s super important to share that and make sure your coverage grows with that. Another thing that happens is we get new toys. Certain types of, of all terrain vehicles, types of e-bikes or e scooters need to have special attention because these sort of modern, fun things.

Often fall between the lines on coverage. And another example here is, especially for our clients who are now, , approaching retirement or into retirement, they may have adult kids that are still hanging out on, for example, their auto insurance. That’s a big no-no. We need to get them onto their own insurance for, your legal protection.

I’d say the fifth. Common pitfall in property casual assurance is failing to meet the underlying coverage requirements. , We see this most often., For example, around umbrella policies. An umbrella policy will usually have certain, home and auto policy requirements that need to be stood up.

For the policy to be and to force. So you can’t get sloppy here and not pay attention to keeping it all coordinated. And, a different form of not meeting the underlying coverage requirements is around your homeowner’s policy. Most homeowner’s policies require coverage to be at least 80 to 100% of the home’s replacement costs.

If you fall short of this. You may face partial payouts , , or even partial losses on that, so it’s very important to get the details right.

So we’ve defined property and casualty insurance and we’ve looked at the most common, pitfall modes around that. So last, we wanna look at some of the specifics that we discovered during our fall planning season where we reviewed property and casualty. Policies in great detail for our clients.

So this worked involved pulling together declaration pages for hundreds of policies and going through property, and real estate records to check ownership to, again, looking for that pitfall , , of owned in a trust or a registered in a trust or LLC, but the policy not showing that. So a lot of.

Detailed work. A lot of quantitative review and a lot of cross checking. So again, here’s what we found and I remind you, we work with some beautiful families, very smart, very intentional, very organized in their finances. So the fact that we see them here means these are super, common to see, and that means you should check your policies too.

Here we go. Let’s begin with homeowners insurance. One of the big gotchas that we found in a couple cases were where the dwelling coverage was less than the rebuild cost of our client’s home. The way we did that is we independently created a rebuild cost estimate using a robust database and, we were able to use that to crosscheck the coverage level.

In several instances, we found the insurance coverage was only 70% of the rebuild cost. And remember that magic regime for having the requirements kick in is often 80 to a hundred percent of replacement cost. Another place that we, detected opportunities is around ownership of certain types of items that have limited coverage on regular policies.

Think artwork, think jewelry, think first, think stamps or musical collections that have, significant value. These things need to be discussed with your insurance agents or insurance carrier because very often it’s appropriate to get a special endorsement, or a listing for that item. So you have. Extra coverage there because without that endorsement or special coverage, that special item will not be covered at the appropriate level.

Still working under home policies. We discovered a number of places where a home was owned in a trust, but not listed on the homeowner policy as an insured entity. Similarly, we found a number of rental properties that are owned by our clients that are owned. Within or held within an LLC, which is a really smart way to do that.

We recommend that folks put rental properties into an LLC for additional legal protections, but that LLC must be listed on the insurance policy for everything to work properly.

And a third example of a titling issue is our clients. Sometimes inherit property and, maybe decide to keep it like it’s a, it’s a family home, a cabin in the mountains or a beach property that has special meaning to the family. So they want to keep it for their own use or, rent it out. So it’s owned by, our client and maybe a couple of their siblings.

It’s important that all of those people are listed on the policy, and better yet that property be held within an LLC.

And a couple unique things that we saw in the domain of homeowners policies defects or opportunities to, make it better. Um, first we found one homeowner that had the wrong type of insurance. They had a landlord policy, a DP three. Instead of a homeowner’s policy. Now landlord policies are designed for non-owner occupied homes, so a huge risk here of a denial of a claim because the property’s actual use as a primary residence does not match the policy’s terms.

The second unique situation we had is we discovered that a homeowner’s policy had the wrong property listed. Our client was insuring their neighbor’s house instead of their own. Last, we had a property that we knew was held in trust, but the property records for the county had not been updated correctly.

So that was kind of a gotcha outside of the policy domain that was detected by doing due due diligence. So a lot of interesting things discovered there, both routine and not routine.

Now let’s move on to auto insurance. And the list of things are much shorter here because the decision and the tailoring of auto insurance, it’s much smaller than, real estate in general. The three most. Common things that we saw, during our review was first around bodily injury coverage and we found a couple instances where it was a hundred thousand dollars per person where it hundred 50,000 or 300,000 are considered a more robust coverage there. And, in a similar vein. For uninsured or underinsured motorist coverage, we found a couple places where it was anonymously low, 25,000 or $50,000 per person.

Whereas a hundred thousand is a much more typical number that, insurance, experts recommend. The third thing we saw here as an opportunity where a number of places where adult children were on the auto policy of their parent, that parent being our client.

We strongly recommend as soon as it makes sense that adult children get out under. Own policy. The parent can still pay for that if they want to, but that separates legal liability. So God forbid the adult child is in an .Accident, and, gets sued, the parents’ assets are not at risk.

Last, let’s talk about umbrella. The thing that we saw most here is a place where it’s either under or uninsured. And when I say uninsured, I’m meaning that the umbrella policy is MIA. It’s not there. It’s missing and this is not uncommon for new clients to the firm. Umbrella policies just don’t get talked about, as much as the others, and I think it’s because.

Homeowners and auto policies are often required. They’re required by the mortgage company. The homeowners, auto insurance is required by state law, so there’s a lot of visibility there. Whereas umbrella is not mandated by any, institutional, regulatory body. So just. It doesn’t have that, the visibility that it deserves.

So again, the typical problems that we are seeing for umbrella coverage is it’s missing or it’s not big enough. And, that not big enough falls under that domain of insurance is not a set it and forget it. Your wealth will grow through time and your umbrella coverage needs to grow to keep up with that.

That said that was the case of having problems with being uninsured or underinsured or umbrella insurance. We found a few cases where folks were over-insured and that’s not an uncommon, optimization issue as well. The point to remember there is that the umbrella policy needs to be sized for the assets at risks.

Which are, often smaller than the net worth of the household. So assets at risk are typically your cash in the bank, your brokerage account, your home equity that is above the home instead exemption. And the reason your assets at risk are sometimes quite often lower than your net worth is because retirement accounts enjoy legal protection very often.

The third piece that we saw around umbrella is again, a trust missing from being listed on the umbrella and policy. So if your home is held by your trust, your trust needs to be on both the homeowner policy and the umbrella policy along with your personal names.

So that’s a review of the specifics, opportunities, and, gaps that we discovered within home auto and umbrella policies . The last thing I wanna say here is some things that are universal to all three of those types of insurance policies. You need to review your deductibles and make sure they are right sized.

You do not want deductibles that are, too low in, a sense that, you’re not gonna file a small claim on your home or auto policy ’cause that’s gonna jack up your premiums. So you wanna rightsize that and, , roughly speaking for a homeowner’s policy. A prudent balanced deductible is probably in the regime of $2,500.

And for an auto policy that’s something around a thousand dollars. And also in the vein of not overpaying. Overpaying is a big deal. There are some insurance carriers that are simply overpriced. It pays to shop around, especially if you haven’t gotten a new quote in the last three years. Unfortunately, carriers often reward your loyalty by quietly cranking up your premiums year over year. A specific couple of examples around it pays to shop around. We had at least a couple client families . Where by redoing and otting the insurance, still getting strong insurance, but getting it at a better price point. Our clients are now saving $5,000 per year on their home and auto policies.

So this is found money. Again, we’re not trying to be cheap, we’re trying to buy smart, not have gaps, but not overpay for protecting your lifestyle.

Remember, friends, a robust financial plan isn’t just about how much you save and how smart you invest, but how well you protect what you’ve built. Don’t let a hidden gap in your insurance today turn into an expensive retirement derailing catastrophe in the future. Take a few minutes to look at your policies, or better yet.

Let your financial planner and your insurance agent review them together. It’s a small step that ensures your financial trajectory remains smooth and steady

Now let’s head over to mission Control to answer your financial questions and get you retirement ready.

Ask Mission Control

In this week’s ask Mission control, our listener question comes from Jane. Thank you so much, Jane, for submitting your question. Jane asks, how is my social security benefit taxed in retirement?

That is a very common question we get, and the short answer is, and this often surprises people, the short answer is. Yes, it’s taxable. Now you’ve spent your working life paying into social security, so it feels like it should be tax free, right? Unfortunately, for many Americans, a portion of those benefits can be subject to federal income tax.

But here’s the key. It all depends on something. The IRS calls combined income. This is where things get a little mathy. So stick with me. Combined income is essentially your adjusted gross income, plus any tax exempt interest plus half of your social security benefits. So the two key drivers there are your adjusted gross income, your a GI and half of your social security benefits.

Once you have that combined income figure. You compare it to the IRS’s base thresholds. For example, if you are married, filing jointly. If your combined income is less than $32,000, your social security benefit is completely tax free. But if your combined income is between 30 2040 $4,000, up to 50% of your social security benefit.

Is taxed and it will be taxed at your ordinary income rate. Finally, if your combined income exceeds $44,000, up to 85% of your social security will be taxable. So for our clients and typically our listeners, you guys , are super savers, and so with the portfolio income you’re receiving, sometimes your pension income and that social security benefit.

Almost always, you’re gonna be in that third tier. So 85% of your social security benefit will be taxed at ordinary income tax rates. Not great news, but at least it’s not a hundred percent right. Notice that key factor. The tax is triggered not just by your social security, but by all of your income sources combined.

Again, pensions required minimum distributions from your IRAs or even a little bit of income from a part-time job in retirement that you’re doing hopefully just for fun

So how do you manage this? You don’t want a huge surprise. Come tax season in April, every January you’ll receive an SSA 10 99 form from the Social Security Administration, which shows the total benefits you’ve received the previous year.

You use this form to calculate what you owe. My number one tip here is to be proactive. You can opt to have federal income tax withheld directly from your Social Security payments by filing form W four V. With the administration, it’s an easy way to manage the tax burden throughout the year so you aren’t scrambling.

Come tax time. Now, this is particularly useful if you are not working with a planner. If you do have a comprehensive financial planner that’s tax focused, they’re gonna be able to manage the tax bill for your social security income and all your. Portfolio income sources in an integrated fashion. But again, if you are rolling your own, I think setting a withholding through form W four V is a great idea.

Now let’s quickly talk about the second tax surprise. That’s state income tax. We were just talking about federal, right? Thankfully, most states do not tax social security income. However, as of today, there’s still a handful of states that do tax social security. These states include places like Colorado, Connecticut, Minnesota, Montana, New Mexico, Rhode Island, Utah, Vermont, and West Virginia.

All have their own sets of rules, often with high income thresholds or age exemptions, the rules are changing rapidly with several states phasing out the tax entirely. But if you live or are planning to retire to one of these states, you need to look up the specific rules there

So wrapping this up, the big takeaway is social security benefits are not automatically tax free. In fact, by default, they tend to be taxed. Whether you pay federal taxes determined by your combined income, and whether you pay state tax depends on your state residence. If you’re doing any kind of tax planning, you must factor in how your retirement withdraws. From a traditional IRA. How can this inadvertently push your income, your combined income, right over a federal threshold and make more of your social security taxable? Don’t let this be a surprise. Talk to your financial planner or your CPA to model your income in retirement and see where your specific thresholds land.

Again, many thanks to Jane for this thoughtful question. If you have your own financial or retirement question that you’d like us to answer on the show, head over to our website at retirement isn’t rocket science.com? Click ask a question. Or even better, you can get to the front of the line by calling us.

At 7 0 4 2 3 4 6 5 5 0 and record your audio question. Again, that’s 7 0 4 2 3 4 6 5 5 0. Now let’s broaden our perspective and explore an explosive corner of our universe, a record setting supernova that erupted right at the cosmic dawn.

Retirement Big Picture

Dr. Chris Mullis, PhD, CFP®: Welcome to the Retirement Big Picture part of our show. This is where we look up and look out to expand our appreciation and understanding of our amazing universe.

Today we’re taking a quick trip back to my old neighborhood astrophysics because the latest news out of the James Web Space Telescope is a true record breaker, and it’s a brilliant reminder that just because something is old, it doesn’t mean it’s what we expect. Astronomers were on the hunt after an international network of observatories detected a super bright flash of light back in March of this year, which they named GRB 25 0 3 14. Alpha GRB stands for gamma ray bursts, and these are the most powerful explosions. In the universe typically marking the death of a massive star.

Here’s the stunning headline. Webb managed to peer through space and time to confirm that this flash came from a supernova, an exploding star that detonated when our universe was only about 730 million years old. That sounds old to us as humans, but remember the universe is now 13.8 billion years old, so this star exploded when the cosmos was barely 5% of its current age.

Putting that on the scale of a 65-year-old woman, this would’ve happened when she was just three years old

this Discovery shatters Webb’s own previous record for the oldest observed Supernova and only Webb, with its incredible sensitivity to infrared light, which is the stretched out light from the earliest most distant objects.

Only Webb could make this direct confirmation

The second big surprise here is what this supernova looked like. Stars in the early universe were expected to be quite different, more massive, with fewer heavy elements. Yet when researchers compare this ancient distant explosion to the supernova that we see in our cosmic neighborhood today, they were shockingly similar.

This is huge. It means the process of massive star death settled into a pattern much earlier in cosmic history than we previously thought. We thought the early universe was wild and messy, but it seems there was already an underlying cosmic plan finally, thanks to Web’s crisp near infrared images, astronomers were able to do something else remarkable. They located the Supernova’s tiny faint host galaxy. This galaxy existed during a time known as the era of Reionization.

A fog filled period of the early universe that we are only now starting to penetrate. Seeing the galaxies is the first step towards understanding the environments where the universe’s very first stars were born. Let’s dig a little deeper here. How was GRB 25 0 3 14 Alpha discovered the process was a race against the clock. It began on March 14th, 2025 when the Franco Chinese SVOM satellite first detected the initial burst of gamma rays within an hour and a half. NASA’s Swift Observatory had quickly zoomed in to pinpoint the sources.

X-Ray location. This rapid multi telescope coordination allowed ground-based telescopes like the VLT in Chile to confirm the tremendous distance of the object setting the stage for web’s later observations.

How did it get its name? Now if you are a loyal listener, you are starting to get a pattern here. Astronomers are not allowed to have a lot of creativity around astronomical names. The name GRB 25 0 3 14 Alpha is a standard astronomical designation for a gamma ray burst.

The number represents the date of detection 25 for the year, 20 25 0 3 for March 14th for the 14th day, and the A. The alpha indicates it was the first GRB detected on that date. Simple. Right, and let’s talk about where it is in the sky. It is in the Constellation, Virgo. Virgo is one of the largest constellations and it’s visible across most of the world, including the United States, particularly during the spring and summer months.

So I suspect you already configured this out, but can we see it in amateur telescopes? Absolutely not gamma ray bursts and their subsequent supernova are fleeting events, and this one in particular is so distant that even its afterglow and the supernovas light require the most powerful professional telescopes like the VLT and the unparalleled sensitivity of the James Webb Space Telescope to detect it an infrared light.

Finally, a super nerdy, but super cool detail. Is the fact that the webspace telescope took its images on July 1st of this year, about three and a half months after the initial gamma ray burst. This timing was deliberate as the light stretching effect of the universe’s expansion meant the underlying supernova was only expected to reach its peak brightness at that moment in time.

The takeaway from all of this, stellar death, GRB 25 0 3 14 alpha is a window. It proves that the fundamental cycle of star life. Starred death was already well underway when the universe was in its infancy, and that consistency is what makes the cosmos and hopefully your retirement plan a little less like rocket science

That’s it for this week. Keep looking up and keep planning ahead. By the way, you’ll find the webspace telescope image of this gamma ray burst in this week’s newsletter. The launch you can sign up for the launch at retirement isn’t rocket science.com. Be sure to check it out.

Conclusion

Dr. Chris Mullis, PhD, CFP®: So what’s your next step for protecting your lifestyle and your retirement? I suggest you make sure you’re reviewing your home, auto, and umbrella policy declarations on an annual basis. For example, look at the rebuild cost of your home. Do you have sufficient dwelling coverage?

Do you have the right endorsements for jewelry and art and other special collections if your property’s held in trust or an LLC? Is that trust or LLC listed on the home policy and on the umbrella policy? And for that matter, does your umbrella policy have enough coverage as your assets at risk grow with your wealth?

And finally, has it been more than a couple years since you shopped for new quotes on your policies, the savings could be significant. I challenge you to take one idea from today’s show and put it into practice this week to protect your lifestyle and make your financial life even better. Thank you so much for joining me. Until next time, I’m Dr. Chris reminding you your next chapter is your greatest chapter and retirement isn’t rocket science.

Credits

Dr. Chris Mullis, PhD, CFP®: We thank the National Aeronautics and Space Administration for providing the radio communication between the space shuttle astronauts and the flight controllers.

Disclaimer

This show is for informational and entertainment purposes only. It is not specific tax, legal or investment advice.

Before considering acting on anything you hear in this show, first consult your own tax, legal or financial advisor.