Estimated Taxes, Marriage 2.0 and Cosmic Bumper Cars

Transitioning from a steady paycheck to retirement can feel like losing your navigation system mid-flight, especially when the IRS expects you to “pay as you go.” Whether you’re facing the 7% underpayment penalty or merging your life with a new partner later in life, the financial stakes are higher than ever. Join Dr. Chris Mullis as he reveals a “time-traveling” tax secret and the essential pre-flight checklist for marriage 2.0 to ensure your retirement stays on a smooth and sustainable trajectory.

Retirement Big Picture

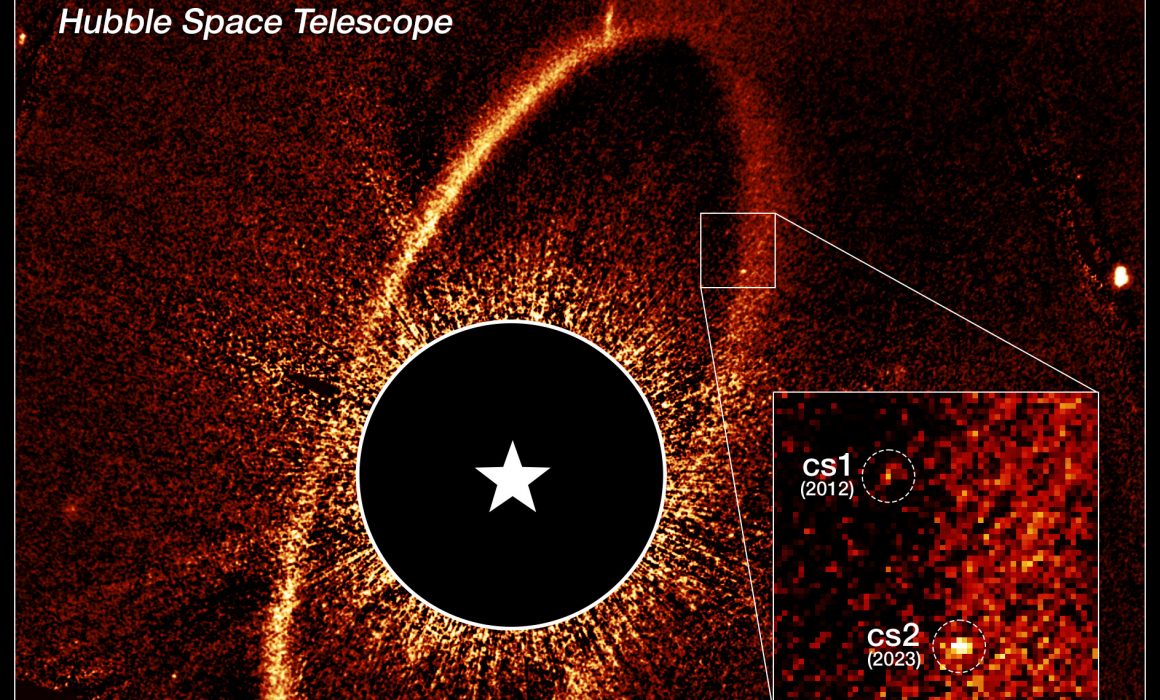

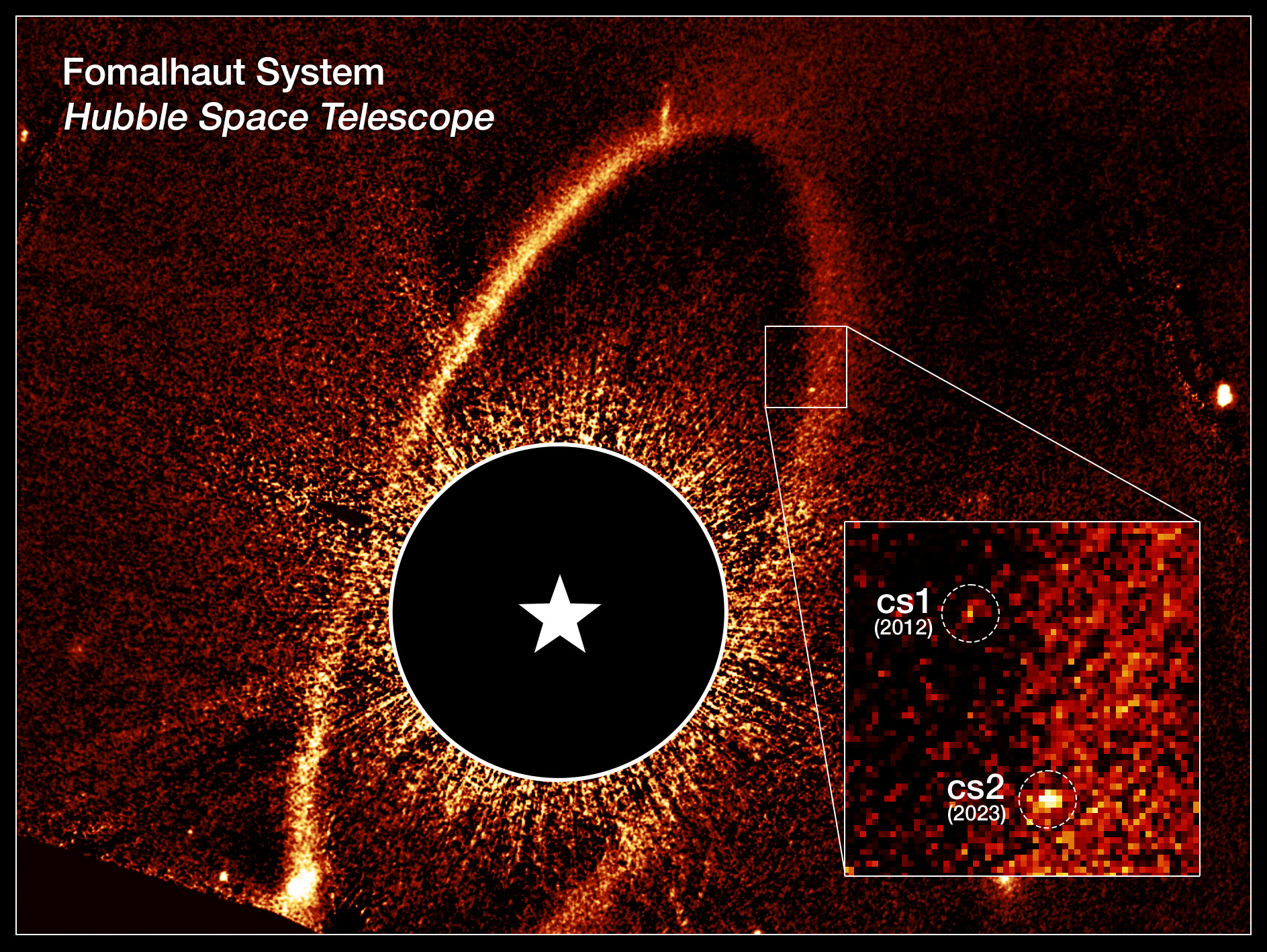

Dr. Chris takes us 25 light years away to the star Fomalhaut to share a cautionary tale about “cosmic bumper cars” and deceptive investments. What astronomers once thought was a solid planet turned out to be a massive, vanishing cloud of dust from a violent asteroid collision—a reminder that what looks like a “sure thing” in your portfolio might just be temporary noise. By looking at the latest James Webb Space Telescope data, we learn that even a “lonely” star can hide a messy, complex system, much like the hidden layers of a modern retirement plan.

Image Credit: NASA, ESA, Paul Kalas(UC Berkeley); Image Processing: Joseph D. (STScI)

Sign Up for The Launch

The Launch is a weekly email from Dr. Chris and his team. It’s full of retirement tips, news, listener questions & more, straight from us to your inbox. Get smarter about retirement in just 5 minutes every week. Let’s go!

Episode Resources

Episode Transcript

Introduction

Dr. Chris Mullis, PhD, CFP®: From Paychex to estimated payments, are you prepared for the retirement tax shift? And what happens when you say I do later in life? And finally, we look at a cosmic fake out when a planet isn’t a planet. Are you ready?

Dr. Chris Mullis, PhD, CFP®: Welcome back to Retirement Isn’t Rocket Science. I’m your host, Dr. Chris Mullis, a practicing retirement planner with 21 years of experience helping clients live their best lives. And before that, I was an astrophysicist who used the world’s largest telescopes on earth and in space to map the structure and evolution of the universe.

Back here on planet Earth, our core mission is to show you how to lower your taxes. Strengthen your portfolio and spend more with confidence so you can make your retirement even better. Along the way, we’re gonna make sure all the dimensions of your money universe are beautiful, effective, and resilient.

And of course, we’re gonna have some fun and learn cool stuff by exploring the most unique places in the cosmos.

Dr. Chris Mullis, PhD, CFP®: In today’s show, we’re tackling a mission critical topic that can feel as complex as orbital dynamics if you aren’t prepared. It’s the transition from the steady withheld paycheck of your career to the pay as you go world of estimated taxes in retirement. And this week’s audio listener question is about marriage 2.0.

They say love is better the second time around, but in a world of retirement planning, it’s also a lot more crowded when you marry later in life. You aren’t just merging two hearts, you’re merging two balance sheets, two sets of heirs, and two different visions of the future. And if you think the stock market is volatile, try living in a solar system that looks a lot like a high speed game of cosmic bumper cars.

Retirement Briefing Room

Dr. Chris Mullis, PhD, CFP®: Welcome to the Retirement Briefing Room. This is where we huddle up to take a close look at important aspects of your financial life, spotlight pathways for success, and think about how to integrate these into your plans to make your retirement even better.

For 30 or 40 years you’ve lived in the W2 universe where your employer handled the taxes, but the moment you retire, you’re in the captain seat.

It’s important to know that the IRS operates on a pay as you go system if you wait until April 15th to pay the taxes on the money you lived on. Last June, the IRS views that as an interest free loan you took from them, and they charge a premium for it

Currently that underpayment penalty is a solid 7%, and that can hurt. To avoid these penalties, you need to hit what’s called the safe harbors. Think of these as the docking stations that guarantee a safe landing. Safe harbor number one involves using the rear view mirror Here.

You pay either a hundred percent. 110% of what you owed last year, that breakdown between a hundred percent and 110% depends on your adjusted gross income. Your A GI if your a GI is less than $150,000. 100% is your bogey. But if you made more than $150,000, your safe harbor is going to be 110% of last year’s bill.

So again, that’s using the rear view mirror to operate in safe harbor number one. But you could also use the second safe harbor, and that involves looking at your current flight plan. You pay 90% of what you expect to owe this year. That’s safe Harbor number two. Here’s a common misstep. We often see many retirees use off the shelf software that automatically generates vouchers based on last year’s income. And many CPAs use this default approach as well. But if your income dropped because you stopped working because you retired, following those vouchers means you’re sending the IRSA huge interest free loan.

A tax focused retirement planner can help you pivot to safe harbor number two, keeping more cash in your pocket throughout the year, and not giving the government a zero interest loan.

Digging in a little deeper, this is where a little bit of rocket science comes into the strategy, so lean in and listen closely. The IRS treats quarterly payments based on when they are received. If you miss the April deadline, you can’t fix it by doubling up on your September payment. You’ll still owe a penalty for those missing months.

However, there’s a really cool workaround. The IRS treats any tax withheld. From your IRA as being paid proportionally throughout the year, regardless of when it actually happened. So here’s the planning opportunity. If it’s December and you realize you haven’t made an estimated payment all year. You can take an IRA distribution withhold a large percentage for taxes, and the IRS will treat it as if you’ve been paying steadily since January.

This time traveling tax payment can wipe out underpayment penalties instantly.

Here’s another scenario. What if you have a big spike in income in the middle of the year? Maybe you sold a property with capital gains in May, or did a big Roth conversion in December. You shouldn’t be penalized in April for money you hadn’t even made yet. Enter the annualized income installment method via forum 2210.

It’s a complex calculation that essentially tells the IRS, I didn’t have the money in Q1, so I shouldn’t have to pay tax. Q1 but good news, any reliable CPA can file form 2210 on your behalf. Now it may take a little bit of a friendly nudge from your financial planner, but your CPA can file that 2210 when you do your taxes and save you thousands in penalties by matching your tax payments to the actual timing of your income.

Finally, don’t forget your state states like California and New York have their own quirky rules and different safe harbor thresholds. At my retirement planning firm, we recommend a centralized withholding strategy. Instead of withholding a little bit from your Social Security or a little bit from your pension and a little bit from your IRA, which creates a tracking nightmare, we suggest withholding nothing from. Those sources accept for clean withholdings from your IRA.

It’s cleaner, easier to track and keeps you in full control of your tax trajectory. Again, the goal is to pay what you owe, but not overpay and not pay too soon or too late.

The objective Of retirement planning isn’t just to have enough money. It’s to keep as much of it as possible. . Don’t let simple procedural errors like underpayment penalties eat into your travel fund. If your income sources are changing this year, let’s make sure your tax strategy changes with them.

After all, your retirement should be about the adventure, not the accounting.

Now let’s head over to Mission Control to answer your financial questions and get you retirement ready.

Ask Mission Control

Dr. Chris Mullis, PhD, CFP®: Discovery Houston, 20 seconds to LOS. Tres Hothead. Nice to be in orbit.

This week we have an audio submission to ask Mission control from a listener in the Queen City. .

Dr. Chris Mullis, PhD, CFP®: That’s a big question. That’s becoming more and more common in my office. What happens when I say I do and I’m age 65 marrying later in life, especially with children from previous relationships, is a beautiful new chapter, but from a financial perspective, it’s like trying to dock two different spacecraft.

While they’re both already in orbit, if you don’t align the speeds and the angles just right, things can get bumpy. When you’re 25 and getting married, you usually start with nothing but a toaster and some student loans. But our listeners are diligent savers and you’ve spent 30 or 40 years saving and very likely, accumulating a very, very healthy nest egg. You have houses, IRAs, and most importantly, a legacy you wanna leave for your own children.

Here are the three big mission control items we have to look at. Number one is the yours, mine, and ours, tax bracket. First, we want to talk about the IRS. Marriage can be a tax bonus or a tax penalty. If one of you has a massive required minimum distribution and the other is still working or has a large pension, jumping into a married filing jointly status may actually push you into a higher tax bracket or trigger higher Medicare premiums.

Those pesky Irma surcharges, a tax focused retirement planner needs to run the numbers to see if your financial orbit stays stable after the wedding.

Number two is the social security switch. This is a big one. If you’re currently receiving survivor benefits from a deceased spouse. Or divorced spouse benefits. Getting remarried can sometimes cause those checks to stop. It’s like a fuel leak. You don’t want to lose that income without realizing it.

So you should always check the launch sequence of your social security before you sign the marriage license. Number three is the legacy tug of war. This is where the analogies really matter. Think of your estate plan like a flight plan if you die without a specific plan. In a second marriage, many state laws act like autopilot, and they usually default to giving everything to their surviving spouse. Now, I know you love your new spouse, but if everything goes to them and then they pass away, your hard earned money might go to their children, leaving your own kids.

Ground. To solve this, we often see good estate planning attorneys use what’s called a Q-tip trust. That’s a qualified terminable interest property trust.

Think of it like a pit stop. It allows your surviving spouse to use the money and live in the house for the rest of their life. It locks in the final destination, so the remaining assets eventually fly back to your children.

To truly prepare to merge your money universes, I recommend you schedule a financial date night before the wedding.

Strongly Consider sitting down with a fee only planner to create a pre-flight checklist. Don’t be surprised if that planner recommends that you confer with legal counsel around a prenuptial agreement, not because you don’t trust each other, but because the only way to likely protect the inheritance that you want your children to receive is through that type of structure.

Also, remember to review your beneficiary destinations on your IRAs and life insurance, those forms. Usually override whatever is written in your will, and I can’t tell you how many times a new client has come to us and we find an ex-spouse listed as the beneficiary of a large asset.

Building a life with someone new in retirement is an incredible adventure. By taking care of the rocket science part of the finances, now you can focus on the ignition of a new purpose, which includes knowing that both your spouse and your children are protected.

Many thanks again for that audio submission from our amazing listener. If you’ve got a question you’d like us to answer on the show, head over to retirement isn’t rocket science.com and click ask a question now let’s broaden our perspective and head out to visit one of the brightest stars in our sky.

Retirement Big Picture

Dr. Chris Mullis, PhD, CFP®: Welcome to the Retirement Big Picture part of our show. This is where we look up and look out to expand our appreciation and understanding of our amazing universe. Today we’re trading the volatility of the stock market for the volatility of the stars. You know, in my career as an astrophysicist, I spent my days looking at the big picture.

Now as a retirement planner, I help you look at your own big picture, but today those two worlds are colliding quite literally in a way that’s a perfect cautionary tale for any investors.

Imagine you’re looking at your portfolio and you see a beautiful investment that looks like an absolute winner. It’s steady, it’s bright. It’s exactly what you want for your 30 year retirement, but then 10 years later, you check back in and that beautiful investment is completely gone.

It wasn’t a solid performance at all. It was just a temporary spike in the noise. That is exactly what happened. 25 light years away in a star called Omaha back in 2008. We thought we’d hit the jackpot. NASA’s Hubble Space Telescope gave us what we thought was the first ever direct image of an exoplanet invisible light.

We named it from a hot bee. It was the darling of the astronomical community. But recently, Hubble looked back and fomo Hot B had vanished into thin air. It turns out it wasn’t a planet at all. It was a massive expanding cloud of dust from a cosmic bumper car collision. Two icy asteroids. Each about 37 miles wide, smashed into each other with such violence that they created a debris cloud large enough to fool our best telescopes into thinking it was a solid planet.

And get this. While the scientists were looking for the ghost of that first collision, now called CS one, they found a second one nearby Dub CS two. According to old theories, we should only see a smash up like this once every 100,000 years. Instead, we’ve seen two in just 20 years. It’s a reminder that the early days of the solar system and maybe the early days of new technology or a market trend are often chaotic, violent, and full of illusions.

This star is a natural laboratory showing us the kind of debris, pelting turmoil that our own earth and moon went through billions of years ago. It’s a milestone discovery for Hubble proving that what looks like a solid planet might just be a very bright temporary mess.

Now if you wanna see this cosmic lab for yourself, you don’t need a PhD or the Hubble Space Telescope. Just a clear autumn night. Omaha is the brightest star in the constellation, Pisces Asus, the Southern Fish. Its name comes from Arabic, meaning the mouth of the fish.

Astronomers often call it the loneliest star because it sits in a part of the sky that is otherwise pretty empty of bright stars.

The Hubble Space Telescope’s Follow on. James Webb Space Telescope has already stepped into the ring to give us a look at the system’s glow in infrared. Which the Hubble can’t quite see as well. So what does JWST bring to the table that Hubble didn’t While Hubble saw the shrapnel invisible light webb’s infrared eyes saw the heat.

Webb’s images recently revealed that FOMO Hot’s house is much messier than we thought. It’s not just one belt of dust. Web found three nested belts of debris. These are like asteroid belts on steroids extending 14 billion miles out. The Web data tells us that there are likely unseen planets hiding in there.

Acting like sheep dogs using their gravity to herd out these distinct rings.

You’ll find the Hubble Space Telescope Image of Omaha in this week’s newsletter. That newsletter’s called the launch and you can sign up for it at retirement.

Isn’t rocket science.com? Finally, a cool thing to note is that Hubble image and much of the research around this object and these collisions is thanks to my fellow graduate from the University of Hawaii’s Institute for Astronomy, Dr. Paul Kallas, who is now a professor at uc, Berkeley. Paul and I overlap for several years as fellow grad students on Oahu.

Conclusion

Dr. Chris Mullis, PhD, CFP®: So what’s your next step for putting knowledge into action and taming your estimated tax payments if you’re doing it yourself? Think about checking last year’s tax return. Look at your total tax. That’s on line 24.

The 10 40. If your income is similar this year to last year, aim to pay a hundred percent through withholdings or estimated payments. Or if your adjusted gross income is over $150,000, you need to bump that up to 110%. Of last year’s tax bill, you’ll find your a GI on line 11 of the 10 40 ,

and if you’re working with a tax focused retirement planner, rest easy. I’m sure they’re focused on getting your estimated tax payments dialed in with a robust tax forecast. I.

As always, thank you so much for joining me. Remember, you’ve done the hard work of earning and saving your money. Now let’s do the smart work of planning. Until next time, keep your eyes on the horizon. Enjoy the adventure. Launching your best retirement starts today.

Credits

Dr. Chris Mullis, PhD, CFP®: We thank the National Aeronautics and Space Administration for providing the radio communication between the space shuttle astronauts and the flight controllers.

Disclaimer

This show is for informational and entertainment purposes only. It is not specific tax, legal or investment advice.

Before considering acting on anything you hear in this show, first consult your own tax, legal or financial advisor.