80% Rule for Retirement Income: Myth or Reality?

If you’re a high-income, high-saver household, you might be overestimating your retirement income needs by 20% or more! That means you could be spending more and retiring sooner. In this episode Dr. Chris breaks down the generic “80% Rule” and shows you how to calculate a custom retirement spending estimate that actually reflects your reality.

Retirement Big Picture

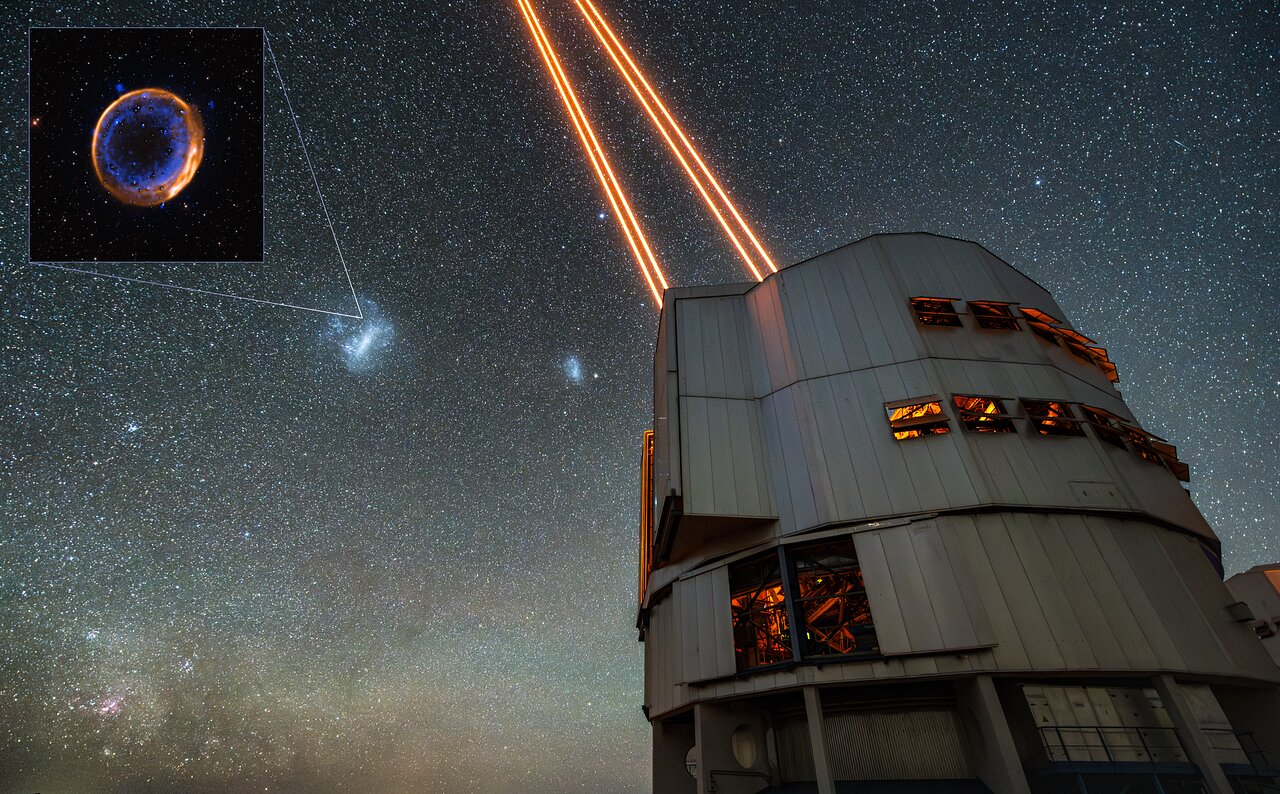

We travel to the Atacama Desert to look at SNR 0509-67.5, a star that exploded NOT ONCE, BUT TWICE in a rare “double detonation” supernova!

Sign Up for The Launch

The Launch is a weekly email from Dr. Chris and his team. It’s full of retirement tips, news, listener questions & more, straight from us to your inbox. Get smarter about retirement in just 5 minutes every week. Let’s go!

Episode Resources

- 7 Steps to Estimating Your In-Retirement Cash Flow Needs

By Christine Benz

Episode Transcript

Introduction

Dr. Chris Mullis, PhD, CFP®: is the 80% rule for estimating your retirement income needs a total myth. When can you switch to the 10 40 Sr. And we head to the Atacama Desert to look at a star that exploded, not just once, but twice. Are you ready?

Dr. Chris Mullis, PhD, CFP®: Welcome back to Retirement Isn’t Rocket Science. I’m your host, Dr. Chris Mullis, a certified financial planner and former rocket scientist.

My mission is to show you how to lower your tax bill, strengthen your portfolio, and spend more with confidence so you can make your retirement even better.

Dr. Chris Mullis, PhD, CFP®: In today’s show, we examine the often cited retirement rule of thumb that you will need to be able to generate enough income to replace 80% of your pre-retirement salary. But we’re gonna go beyond that rule of thumb and drill down to a much more accurate retirement spending estimate for your household that more fully reflects.

Your unique circumstances and this week’s listener question is all about the 10 40 sr. A special form that promises to simplify tax season for retirees. Let’s find out exactly when you can get to launch this new easier form, and we take a look at a double detonation. A new image from my old observatory in Chile shows the remains of a star destroyed by a pair of explosions. Now let’s dive in.

Retirement Briefing Room

Dr. Chris Mullis, PhD, CFP®: Welcome to the Retirement Briefing Room. This is where we huddle up to take a close look at retirement related research and news articles to think through how to integrate these into your retirement plans so we can help you make your retirement even better. This week we’re diving into a great piece of research.

Titled Seven Steps to Estimating Your In Retirement Cash Flow Needs. Written by Christine Bins and published in Morningstar. Christine is a longtime industry expert and director of personal finance at Morningstar, and her work is a fantastic blend of solid data and practical advice.

This article tackles a fundamental question that causes so much anxiety. How much money will you actually need to spend in retirement

Now, if you’re nearing or in early retirement, you’ve probably heard the old advice that you need about 80% of your pre-retirement income to maintain your retirement lifestyle. Now, for many people that’s a decent starting point. But for our audience, you know, diligence savers who’ve accumulated a pretty healthy nest egg, that number may be way off.

Christine’s article, which builds on research by financial experts confirms what we’ve seen in practice for the last two decades at my retirement planning firm for high income, high savings households, your actual income replacement rate in retirement could be 60% or even less of your working income.

Think about that, a difference of 20 percentage points. In your needed income is a massive change that could completely reframe your entire retirement plan. Now let’s walk through the steps that Christine outlines for calculating your custom retirement cash flow, and I’ll explain the strategic implications for you as we move along.

Part one is to establish your baseline income and then subtract your retirement savings. Now let’s break that down. First you start with your current income. That’s Your income before retiring. We use that as a baseline for the lifestyle you want to maintain, but then you immediately subtract your savings rate, which is the key reason why the 80% rule is often too high for super srs.

If you are a great saver, say you’re putting away 20% or more of your income into your 401k, your IRAs, or even your brokerage account, that money disappears the moment you stop working. You no longer have to replace that 20% savings portion in retirement. So right there, your required income drops from a hundred percent to 80%, and that’s before considering any other changes.

Now, this is a huge opportunity because it can make your retirement savings look much more durable and sustainable right out of the gate. Moving to part two, we are now incorporating your potential tax, housing, and lifestyle changes.

This is where financial planning truly shines. Step one, let’s consider taxes when you retire, you stop paying Social Security and Medicare payroll taxes, which are about 7.65% of your income. Up to the social security wage base that’s a guaranteed reduction.

Even better, you have much more control over your taxable income. With proper tax planning. A certified financial planner can help you strategically draw from Roth accounts, traditional IRAs, and taxable brokerage accounts to keep you in a lower tax bracket.

This strategy is critical to managing your long-term tax bill, especially before required minimum distributions. Kick in at age 73 and potentially push your tax rate higher. Then let’s look at your housing and lifestyle. If you plan to pay off your mortgage, downsize, or move to a lower cost area, those housing cost reductions can be substantial.

Likewise, you eliminate costs like commuting work clothes, and sometimes expensive work lunches. However, honest with yourself, if you plan to trade that commuting expense for a heavy travel schedule or a new expensive hobby. Those lifestyle changes might actually increase your cashflow needs

finally, we move to part three, which is the healthcare wild card and the fudge factor. Now we need to talk about the one area that will likely increase your expenses. And that’s healthcare.

Christine notes that the average out-of-pocket lifetime. Healthcare outlay for a 65-year-old is over $170,000, and that doesn’t even include long-term care. This massive potential expense must be incorporated into your income and investment plan, and I would add your tax plan as well.

How will you pay for this? If you retire early, it’s very likely you’re gonna be on the a CA healthcare system. And then as you reach age 65, you’ll transition to either traditional Medicare with a Medigap policy or a Medicare Advantage plan. But choose wisely because the decision you make at that onset of Medicare is something that sets a course for the rest of retirement very often.

And then around the edges, we’ll want to optimize using your health savings account. Managing your Medicare surcharges and the biggest swing factor, your long-term care strategy. For our clients who are very often super savers, we have to look at the opportunity cost of self-insuring very often with savings and or their home equity versus paying the premium of a comprehensive long-term care policy.

It’s a critical component of your wealth preservation and insurance planning. And the last component is the proverbial fudge factor. Finally, Christine recommends adding a fudge factor, a buffer for the unknown. This could be unexpected home repairs, a need to assist an adult child or a grandchild, or those truly unpredictable healthcare costs.

This extra cushion is a way of building risk management into your cashflow projection. Having a slightly higher target means your investment portfolio needs to be structured for higher than expected withdrawals without running out of money, which ties directly into our investment planning philosophy of creating a durable diversified portfolio, plus a smart income strategy that can withstand market and economic turbulence.

The value of working with a fee only certified financial planner on this specific issue is clarity and strategy. We don’t just guess your retirement number. We sit down and go through these steps and many more. With you customizing your spending plan, building that tax efficient withdrawal strategy, and integrating your estate and insurance plans to cover the biggest risks.

It allows you to feel truly confident. In your monthly paycheck in retirement and maximize your spendable money without running out of money before you run out of life.

In closing, don’t let a generic rule of thumb dictate your retirement life. By calculating your custom cash flow need, you can unlock a greater sense of security and maybe even realize you can spend a little more on that new adventure sooner than you thought. It’s about knowing your numbers, not guessing.

That’s how you truly launch a successful retirement.

We thank author Christine Bins for this Thoughtful retirement article. If you’re interested in learning more, there’s a link to the Morningstar article in today’s show notes that you’ll find in our newsletter called The Launch.

You can sign up for the launch at retirement isn’t rocket science.com. Now let’s head over to Mission Control to answer your financial and retirement questions.

Ask Mission Control

In this week’s Ask Mission Control, our listener question comes from Tom. Tom asks, when can I start using the 10 40 Sr.

So my tax preparation is easier that’s a fantastic question and one we often hear there are so many moving parts to retirement from Social Security to Medicare, and it’s nice to know the IRS throws us a bone once in a while. The 10 40 SR. Or US tax return for seniors is definitely one of those perks.

The short answer is this. You can use the 10 40 SR for either the tax year in which you turn age 65. It doesn’t matter if your 65th birthday is on December 31st of that year, you’re good to go for the entire tax year. And if you’re married, filing jointly as long as one of you is age 65. By the end of the year you qualify to use the 10 40 Sr. The beauty of the 10 40 Sr is that it’s simply designed with seniors in mind. It’s not a whole new tax code, but it’s a slightly streamlined version of the standard 10 40.

It uses a larger font size, which is a nice touch, and it specifically highlights areas that are most relevant to retirees. For example, it clearly calls out spaces for things like your social security benefits and any distributions from your retirement accounts. It also has a specific section for the standard deduction for people age 65 and older.

There are a couple more details to keep in mind. First, there are no income limits regardless of the amount or type of income you make. A taxpayer who meets the age requirement can use the 10 40 Sr. Two, it can be used with all and any other forms like the standard 10 40. The 10 40 SR can be used with all other necessary IRS schedules and forms to report additional income.

Deductions or credits. And three, it’s totally optional for seniors. If you’re a diehard fan of the classic 10 40 good news eligible taxpayers are not required to use this special form. Seniors can still file with the standard 10 40 if they prefer.

For many of you using the 10 40 Sr will feel easier, but here’s where a retirement isn’t. Rocket science perspective comes in. The form you’d use is only one small part of a much larger mission.

A lot of the true tax complexity for our listeners isn’t about filling out the form. It’s about the strategic planning that happens before you even start the tax preparation. This is where a certified financial planner that specializes in retirement.

And focuses on taxes can really act as your mission control. For instance, in my practice, we’re always looking ahead at your tax management trajectory. We don’t just focus on this year’s tax bill. We’re trying to minimize your taxes over your entire retirement. This includes strategies like Roth conversions.

We’re proactively converting pre-tax IRA money to Roth accounts. To lower future required minimum distributions and lower the potential tax tsunami of mid and late retirement. We’re also looking at charitable giving.

Are we using qualified charitable distributions or qds from your IRA, which is a powerful tax-free way to meet your charitable goals once you hit age 70 and a half? And we’re also looking at investment placement. Are your tax efficient investments held in taxable accounts and your growth oriented less tax efficient funds held in your tax deferred accounts?

Now the 10 40 SR is a nice user-friendly piece of paper, but it doesn’t solve a poor tax strategy. That’s why working with an advisor who integrates tax planning into your investment income and estate planning is very important. We make sure the strategy behind the forum is sound. So when your tax preparer uses the 10 40 Sr or the 10 40, the numbers already reflect.

Years of smart decisions, it ensures your smooth and sustainable financial orbit. In short, enjoy the simpler form at age 65, but remember, the true simplicity and retirement comes from a great plan, not just a user-friendly tax form .

Many thanks to Tom for this great question. If you’ve got a retirement question that you’d like us to answer on the show, head over to retirement isn’t rocket science.com and click ask a question. Or even better, you can skip to the front of the line by calling Mission Control at 7 0 4 2 3 4 6 5 5 0 and record your audio question. Again, that’s 7 0 4 2 3 4 6 5 5 0. Now let’s broaden our perspective and explore a beautiful. An explosive corner of our universe.

Retirement Big Picture

Dr. Chris Mullis, PhD, CFP®: Welcome to the Retirement Big Picture part of our show. This is where we look up and look out to expand our appreciation and understanding of our amazing universe. Today’s featured object comes courtesy of my former colleagues at the European Southern Observatory, where I did my post doctoral research established as an inter-government organization in 1962.

ESO is supported by 16 member states ISO’s headquarters are located in Munich, Germany while the Chilean Aama desert. A marvelous place with unique conditions to observe. The sky hosts esos telescopes as a freshly minted PhD. My wife and I lived in Germany and I worked out of Germany, but commuted to Chile to conduct my research

The object of our discussion today is SNR 0 5 0 9 dash 67.5. That SNR stands for Supernova remnant. It’s the centuries old remains of a dead star, and the big news astronomers now have the first ever visual evidence that this star, a white dwarf didn’t just explode once. It blew up in a double detonation.

Now a white dwarf is the dense small core left behind after a star, very much like our son runs outta fuel. They are typically dormant, but if one is orbiting a companion star, it can act like a cosmic vampire stealing match until it reaches a critical limit. Known as as Sacar Mass. At that point, it’s supposed to detonate in a single massive type one A supernova,

But this new finding published recently proves there’s an alternative quicker path to destruction. In the double detonation model, the white door siphons enough helium from its partner to form a blanket on its surface. That helium blanket becomes unstable and ignites first, creating a powerful shockwave.

This shockwave travels inward, compressing the stars core, and triggers a second core shattering explosion all before it hits that traditional critical mass limit. Two bangs for the price of why is this a big deal? Well, in retirement planning you need predictable income, right? In astronomy, we need predictable explosions. Type one a supernova are essential to our field because they act as a cosmic measuring tape. Since they explode with nearly the same intrinsic brightness, we can use them to calculate vast distances across space.

It was by using these standard candles that astronomers discovered the accelerating expansion of the universe, a finding that earned them the 2011 Noble Prize in physics. I had the occasion to work with that Noble Prize winning team later in a Hubble Space Telescope program where they hunted supernova explosions in galaxy clusters that I discovered.

With my team members. Now back to the supernova story. If we misunderstand how they explode the details of their detonation, we mess up our cosmic ruler. This discovery helps us fine tune that cosmic measuring tape and gives us a better handle on the universe’s expansion.

Plus, type one a supernova are the cosmos’s main forge for iron, the very important element that’s in our blood. You could say this double detonation is both beautiful and fundamentally important.

Before we wrap up, let’s dive a little deeper into the logistics of this incredible stellar corpse, SNR 0 5 0 9 dash 67.5. First, how did we find it and how did it get its name?

The explosion itself happened approximately 400 years ago. Which means the light reached Earth. Around the time Galileo was looking through his first telescope, the remnant was first cataloged and studied in detail much later. The SNR stands for Supernova Remnant and the numbers 0 5 0 9 dash 67.5 R.

Its coordinates in the sky much like a cosmic address

This object resides in the large Malan cloud. We’ve talked about that recently because it’s also home to the tarantula Nebula, and you’ll probably recall the large Malan cloud or the LMC is a small satellite galaxy orbiting our own Milky Way. About 160,000 light years away.

Now where’s this object on the sky? The supernova remnant is in the large Maggi cloud in the far southern constellation of Dorado. The swordfish, unfortunately for our listeners in the continental of United States, the LMC and the Constellation Dorado are located too far south in the sky to ever rise above the horizon.

So it’s not visible to us here in the us. However, for professional astronomers, it’s absolutely a target. The VLT that made this new discovery is located in the Southern hemisphere in the Atacama Desert of Chile, which gives it a very clear view of the large Malan cloud.

Conclusion

Dr. Chris Mullis, PhD, CFP®: You’ll find a stunning image of that supernova explosion plus a picture of the very cool telescope that studied it along with today’s show notes and featured retirement article in our newsletter called The Launch.

You can sign up for the launch at retirement isn’t rocket science.com? So what’s your next step? I challenge you to take one idea from today’s show and put it into practice this week to help make your retirement even better. Thank you so much for joining me. Until next time, I’m Dr. Chris reminding you retirement isn’t rocket science.

Credits

Dr. Chris Mullis, PhD, CFP®: We thank the National Aeronautics and Space Administration for providing the radio communication between the space shuttle astronauts and the flight controllers.

Disclaimer

This show is for informational and entertainment purposes only. It is not specific tax, legal or investment advice.

Before considering acting on anything you hear in this show, first consult your own tax, legal or financial advisor.