Beyond the 4% Rule: Avoiding a “Starless” Retirement

Most financial advisors tell you to spend a flat, steady line of income for 30 years, but why should your retirement spending look like a boring horizontal line when your life doesn’t? In this episode, Dr. Chris Mullis explains why “front-loading” your spending during your healthiest years isn’t just fun—it’s a scientifically backed strategy to maximize your life’s “kinetic energy.” Discover how to stop over-saving and start spending your hard-earned nest egg with the confidence of a rocket scientist.

Retirement Big Picture

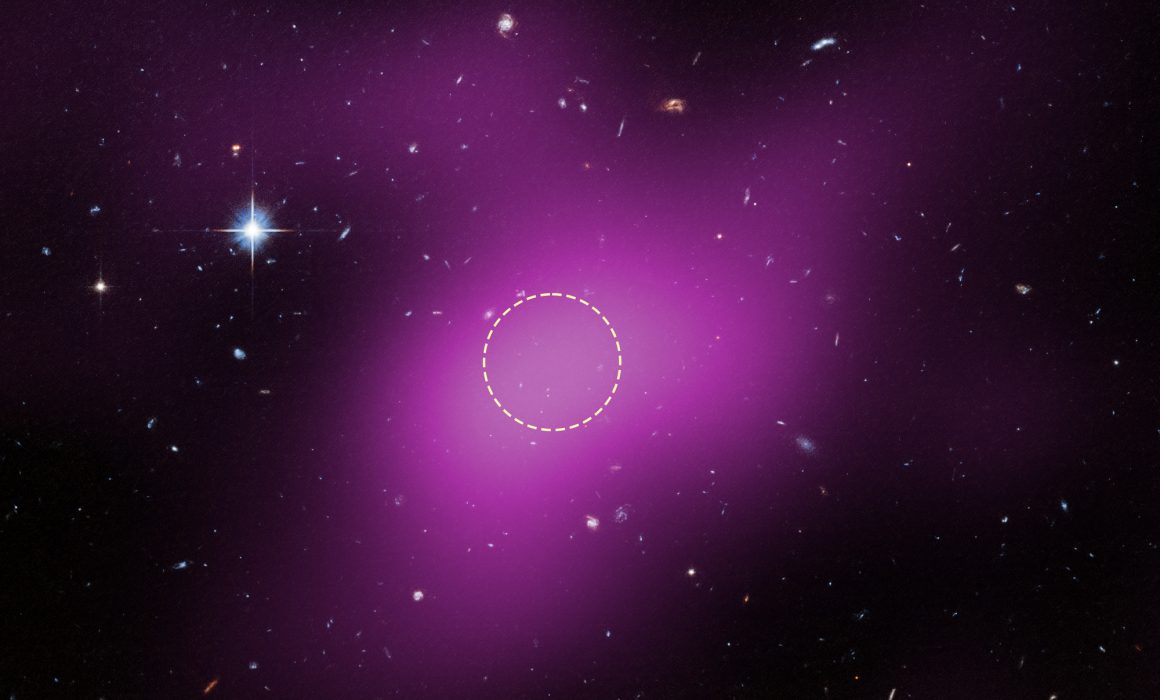

Cloud Nine is a “failed galaxy” that contains all the necessary dark matter and hydrogen gas but never actually formed a single star. This celestial relic, located 14 million light-years away, serves as a metaphor for “failed investments” and the importance of stress-testing theories through high-resolution observation. Much like the Hubble Telescope confirmed the starless void of Cloud Nine, a certified financial planner helps you look through the “atmospheric distortion” of financial jargon to ensure your retirement plan actually ignites into the life you’ve imagined.

Image Credit: NASA, ESA, VLA, Gagandeep Anand (STScI), Alejandro Benitez-Llambay (University of Milano-Bicocca); Image Processing: Joseph DePasquale (STScI)

Sign Up for The Launch

The Launch is a weekly email from Dr. Chris and his team. It’s full of retirement tips, news, listener questions & more, straight from us to your inbox. Get smarter about retirement in just 5 minutes every week. Let’s go!

Episode Resources

- Most Retirees Want to Front-Load Their Spending

By Dr. Michael Finke

Episode Transcript

Introduction

Dr. Chris Mullis, PhD, CFP®: When we launch a rocket, we don’t use the same amount of fuel at every stage of the journey. Most of the energy is spent right at the beginning to break Earth’s gravity. So why does the financial industry tell you that your retirement spending should be a flat, steady line for 30 years? Today we’re looking at why spending more now might actually be the smartest move you ever make. Are you ready?

NASA: 3, 2, 1, 0 and lift off. Lift fell Americans return to space as discovery clears the tower.

Dr. Chris Mullis, PhD, CFP®: Welcome back to Retirement Isn’t Rocket Science. I’m your host, Dr. Chris Mullis, a certified financial planner with twenty-one years of experience helping good people enjoy great retirements. And in the past life as an observational astrophysicist, I’ve mapped the structure of the universe using NASA’s great space observatories.

Back here on Earth. Our core mission is to show you how to lower your taxes, strengthen your portfolio, and spend more with confidence so you can make your retirement even better. And if that wasn’t enough, we’re going to have some fun and learn cool stuff by exploring the most unique places in the cosmos .

Dr. Chris Mullis, PhD, CFP®: In today’s show is your retirement plan, ignoring your health, why the 4% rule might be sabotaging your best years, and how do you guess your expiration date so you don’t accidentally run out of money in retirement? And finally, the galaxy that never was. Why astronomers are on Cloud nine over a starless void.

Retirement Briefing Room

Dr. Chris Mullis, PhD, CFP®: Welcome to the Retirement Briefing Room. This is where we huddle up to take a close look at important aspects of your financial life spotlight, pathways of success.

Think about how to integrate these into your retirement mission plan.

Today we’re highlighting an excellent article entitled Most Retirees Want To Front Load Their Spending. It’s written by Dr. Michael Finca and published in Advisor Perspectives.

It both challenges the conventional wisdom of financial planning, like the 4% rule for retirement income spending, and it aligns perfectly with my background in optimization. Finding the sweet spot between fuel efficiency and reaching the destination of your retirement with maximum impact.

First, a little background about the author, Dr. Finca is a Professor of Wealth Management and the Frank m Engle, distinguished Chair in Economic Security at the American College of Financial Services. He is one of the nation’s leading researchers on how retirees actually behave and make financial decisions in the real world.

In the realm of physics, we talk about kinetic energy, the energy of motion in retirement. Your kinetic energy is highest in those first 10 years. Dr. Fincas, latest research confirms what I’ve seen in my office for more than two decades. Retirees don’t want a flat spending line. Most financial software assumes you spend exactly the same amount adjusted for inflation until the day you pass away at age 95.

But Dr. Fincas study of 2000 savers shows that two thirds of the people would rather spend more while they are young and healthy. We call these the Go-Go years. Why wait until you’re 85 to take that European river cruise when you might not have the knees or the desire to do it?

Then consider health span versus longevity. The biological clock, Dr. Finca introduces a concept we talk about often here. Health span longevity is how long you live. Health span is how long you are active. He cites fellow researcher mosh Ky, who says your biological age should dictate your spending.

Think of it like this. If you’re a 65-year-old diligent saver and you’re in great shape, your mission duration is longer and you need to pace yourself. But if you’ve had health scares or if your family history suggests a shorter flight plan of life, the math changes.

Dr. Finca points out that the enjoyment we get from vacations or dining out declines as cognitive and physical abilities dip. As a retirement planner, I’m not just looking at your bank account, I’m looking at your hiking boots if you want to use them, we need to fund that now.

Consider the financial physics sequence of risk and inflation. Let’s look at these mission constraints. If you spend more early, you face two main gravitational polls, sequence of return, risk, and inflation. Let’s take those one at a time. First sequence risk. If you take large withdrawals in your sixties and the market hits a proverbial black hole, which is a downturn, we know they come.

We just don’t know their exact timing. If the market hits a black hole, you’re selling shares when they’re down, that can permanently lower your trajectory. And then number two, the money illusion. This is what Dr. Fink calls nominal spending. By the way, nominal is a great NASA speak word. Hey, if someone asks you how you’re doing or how’s your day, just say nominal.

So nominal spending. If you spend $100,000 this year and $100,000 next year, you’ve actually spent less because inflation ate your power of spending. Inflation ate your purchasing power. This is where a certified financial planner earns their keep. We have to balance your desire for frontloading with the reality that a gallon of milk might cost $15.

By the time you’re 90, we solve this by bucketing your investments, keeping your go-go money and safer, accessible orbits while letting your long-term money stay in growth mode.

Now let’s talk strategy in terms of the social security safety net. Dr. Finkah Makes a brilliant point about social security. You might think. I wanna spend more now, so I’ll take my social security at 62, eh, wrong. The rocket scientist move is often the opposite. Use your private savings that is, use your IRAs to fund the fund in your sixties.

Meanwhile, let your social security benefit grow by 8% a year until age 70. This creates a massive inflation protected floor. For your eighties and nineties,

it’s like having a reserve fuel tank that automatically refills. It gives you the permission to spend your portfolio today because you know that guaranteed check is waiting for you later.

Remember, you spent 40 years focused on the accumulation phase, building your beautiful rocket, filling it up. Now you’re in utilization phase. The goal isn’t to land with the most fuel left in the tank. The goal is to have the most incredible mission possible. So don’t let that generic 4% rule keep you grounded during your best years.

The article didn’t go into the following detail, but I wanted to add this on for greater context. In retirement income planning, there is this concept called the retirement smile that describes how a retiree spending tends to change over time. Instead of spending a flat amount every year adjusted for inflation.

Research shows that most people follow a U-shaped curve that looks like a smile

And this concept of the article that is most people want to front load or spend more of their money in the early part of retirement when they’re younger and healthier is that left side of the smile, when working with our clients, I often describe the smile in three phases. It’s the go-go slow go , and no-go years. Now let’s look at those one at a time. The go-go years, that’s early retirement. The left side of the smile spending is typically high. There’s activity. This is when you are healthiest and most active.

You finally have the time to travel, indulge in sometimes expensive hobbies and dine out more.

Discretionary spending peaks as you check items off your bucket list. Then we move into phase two, the slow years of mid retirement. This is the bottom of their retirement. Smile. Spending naturally dips in terms of activity as energy levels decline, you might trade international trips for local getaways or quiet time with your family.

And in terms of cost, real spending often decreases as the desire for high cost lifestyle activities fades. You’ve already bought the big things you wanted at the start of retirement, so you’re in the steady Eddy part of it. And then finally we have the third stage. That’s the no-go years of late retirement, and that creates the right side of the smile, spending ticks back upwards.

So in terms of activity, physical mobility is often limited, and social circles may become smaller in terms of cost

while travel and leisure spending dropped to nearly zero, healthcare and long-term care costs usually spike. This creates the upward curve of spending of the retirement income. Smile. So why does this matter to your planning? Understanding the smile can drastically change how you view your retirement number.

So it helps you avoid potentially overs. saving . The traditional model assumes you need a steady inflation adjusted income forever. The smile concept suggests that because spending dips in the middle years, you might actually need 15 or 20% less in total savings than the static approach suggests. And we’ve done an entire podcast.

On estimating your retirement income needs. So go back and listen to episode number four if that’s interesting to you. And then again, with a smile. That front loading fun concept comes into play. It gives you permission to spend more in your early years while you’re healthy enough to enjoy it, provided you have accounted for the spike in healthcare spending later in life.

Now we’re not gonna be able to get into too many details in today’s show. This will be something we try to cover in a future episode.

Instead of a rigid 4% withdrawal rule, we use a guardrails approach that allows for higher spending in the go-go years and smaller adjustments as you move into this logo phase. So the takeaway here is real world retirement spending is not a straight line. It’s a curve. Planning for a dip in the middle of your retirement can help you live more fully in the beginning without running outta money at the end I.

We thank Dr. Finca for his amazing research and this thoughtful article. You’ll find a link to it in today’s show notes and in our weekly newsletter. Now let’s head over to mission Control to answer your financial questions and get you retirement ready.

NASA: Discovery Houston, 20 seconds to LOS. Tres Hothead. Nice to be in orbit.

Ask Mission Control

Welcome to Ask Mission Control. If you’ve got a retirement question you’d like us to answer on the show, head over to retirement isn’t Rocket science.com and click Ask a question. Or even better, you can skip to the front of the line by calling Mission Control at 7 0 4 2 3 4 6 5 5 0 and record your audio question.

Again, that’s 7 0 4 2 3 4 6 5 5 0

Today we’re tackling a question that feels a bit like trying to calculate the trajectory of a comment without knowing its speed. A listener asks, how can I get a better handle on how long I’ll live so I can plan my future with confidence?

Now I know what you’re thinking. Dr. Chris, I’m not a fortune teller. You’re right, but in the world of rocket science, we never deal with a hundred percent certainty. We deal with probabilities. Most people look at the social security tables and see the average life expectancy. Maybe it’s 84 or 86, but here’s the problem.

Average is a very dangerous word. For listeners like you, if you are 65 today and you’re not a smoker and you’re in good health, there’s a very real chance about 25% that you’ll be blowing out 95 or 96 candles on your last birthday cake. Now, if you plan for 86 and you live to 96, that’s a 10 year fuel shortage at the end of your trip.

That is not the kind of reentry we want, so how do we get a better estimate? Recent research shows that one of the most powerful predictors of longevity isn’t just your DNA, it’s your own mission control report. Simply Put, how do you feel people who describe their health as excellent? Good, consistently outlive those that don’t.

It turns out your body is a pretty good sensor for its own durability. Now, when I’m sitting down with clients, I recommend using tools like the Society of Actuaries Longevity Illustrator. It doesn’t try to sell you insurance. It just looks at the math. It gives you the probability of reaching certain ages.

For a couple, there’s a high probability at least one of you will make it into your nineties. This has massive implications for your financial orbit and your retirement plans.

First, think about social security. That’s. Oftentimes considered longevity insurance if you are the higher earner of a couple and you’re in great health, delaying your benefits until age 70 is like upgrading your heat shield. It guarantees a higher inflation adjusted check for as long as you live and your partner lives.

But. There’s a human element to this too. You need to sit down with your partner and have a money history talk. We all carry money baggage from our childhood. Maybe your spouse grew up in a home where money was tight, and the idea of living too long creates a lot of anxiety for them.

You need to align on these fears before you can align on the numbers. As always, mastering your retirement isn’t about knowing the exact day you’ll stop breathing. It’s about building a ship that can handle the longest possible journey. And when I say longest possible journey, longest reasonable from a probabilistic point of view.

This is because in this chapter of life, the risk isn’t just that things go wrong, it’s that things go right. You live a long, vibrant life that lasts longer than your paycheck. That is not what anyone wants, right? So remember, retirement planning is a marathon, not a sprint. You might just find yourself running a few extra miles.

Don’t let those extra years catch you by surprise. Prepare for the long orbit and enjoy the view.

Many thanks again to our thoughtful listener for submitting this timely question, pun intended. Now let’s broaden our perspective and head over to cloud nine.

NASA: In Discovery Houston, we’ve got a good picture of Steve.

Retirement Big Picture

Dr. Chris Mullis, PhD, CFP®: Welcome to the Retirement Big Picture part of our show. This is where we look up and look out to expand our appreciation and understanding of our amazing universe. Before I was a certified financial planner and retirement planning specialist, I spent almost two decades studying the cosmos. As an observational astrophysicist.

So This subject is near and dear to my heart. Let me just take a moment to connect the dots between astrophysicist and rocket science. Much of my research and much of the most cutting edge research in astrophysics takes place using space born observatories, IE telescopes in space. Those telescopes, of course, get to orbit on rockets, and we go into space for two primary reasons.

Number one, to access different wavelengths of light that we can’t observe directly from the earth’s surface. So for example, x-ray astronomy. My specialty was x-ray astronomy. We cannot conduct x-ray astronomy from the surface of the earth because the earth’s atmosphere absorbs cosmic x-rays.

By the way, if that atmosphere wasn’t there to block that x-ray radiation, we would not be alive to have this podcast and have these great retirements.

so we go to space to access different parts of the electromagnetic spectrum. Say that 10 times. So things like x-rays, infrared, we can do a limited amount of near infrared astronomy from the high observatory locations on earth, but we truly have to go into space to do, rigorous infrared observations.

So number one reason to go to space is to access things that we can’t do from the earth’s surface. The second reason to go to space is for. More detailed, views, when we put our telescopes above the Earth’s atmosphere, our resolution gets better because the Earth’s atmosphere is very yummy and oxygen rich and great for us.

But it’s like birdwatching from the bottom of a pool. The atmosphere creates a lot of distortion in our images. So to get the most detailed imaging possible, we need to put our telescopes in space. That’s why you see incredible crisp views from the Hubble Space Telescope. Also the James Webb Space Telescope.

So that’s the rocket science astronomy connection. Gotta get your telescopes up high. Going back to my old specialty of x-ray astronomy, you could get that x-ray telescope up in space if you’re on a tight, tight budget. You could use a high altitude balloon or a sounding rocket, but to do it right, you want a stable, long duration platform that comes from being on orbit

Today we are bridging those two worlds, astronomy and retirement planning because NASA just dropped a new press release that’s quite literally a lesson in failed investments on a cosmic scale. You know, one of my barometers for how popular an astronomical object is.

In the, journal public is my clients. Write me about it. And thanks to my client, who will remain nameless to protect her confidentiality, privacy is number one, right? But I had a client write this past week and ask about this object, which got it to the top of the queue. So if there’s anything happening in the astronomy world that you want us to dive into a little bit deeper, you know how to reach out to us.

Through retirement is@rocketscience.com. So Think about this. What if you had all the ingredients for a perfect retirement, the savings, the plan, the property, but you just never actually retired? Well, the universe just found a galaxy that did exactly that. It has the gas, it has the gravity, but it never made a single star.

It’s a cosmic relic and it’s a telling story about the universe’s hidden portfolio.

Now let’s look at that. Cosmic failed investment in my line of work as a retirement planner. We’re usually focused on thoughtful growth. We wanna see our clients’ investments continue to proverbially light up,

but in astrophysics, sometimes the most valuable thing that you can find is a failure. A team using the Hubble Space Telescope has just confirmed the existence of a brand new type of object. They nicknamed it Cloud nine, but what we call it is a Relic, R-E-L-H-I-C.

That stands for Reionization Limited H one Cloud. NASA and scientists love acronyms, right? It sounds like a lot of jargon, but just think of it as a failed galaxy. Imagine a construction site where a luxury skyscraper, you’ve got the foundation that’s the dark matter, and you’ve got all the lumber and steel sitting in the yard.

That’s the hydrogen gas here. But for some reason, the workers never showed up. No building was ever built. That is cloud nine. It is a starless, gas rich cloud of dark matter that’s been sitting there unchanged since the very early days of the universe.

Why is this a big deal? Because for years we’ve had these theories. The math of the universe predicting that these starless ghosts should exist, but we couldn’t find them. We’d seen hydrogen clouds, but they were usually messy or had a few stars tucked away.

Cloud nine is different. It’s compact, it’s spherical, and thanks to the Hubble’s advanced camera for surveys. We can finally say with 100% certainty, there’s nobody home, no stars, no light, just the massive invisible scaffolding of dark matter holding a million suns worth of hydrogen gas. Alexandra Benitez, Lumbe, the lead scientist, said it best quote, seeing no stars is what proves the theory. Right? In retirement planning, we call that a stress test. Couple just stress tested our theory of galaxy formation and it held up cloud nine Enzo window in the dark part of the universe. We usually can’t see because it doesn’t emit light.

It’s the ultimate primordial building block. A fossil from the dawn of time that just stopped.

For a complete picture. Let’s dig into the Cloud nine dossier. Let’s get into the how and where this discovery. For all you backyard observers. So it wasn’t actually Hubble that spotted it first. It was a team effort. It was first detected about three years ago during a radio survey by the fast telescope in China, the world’s largest radio dish.

It was later confirmed by the Green Bank telescope. That’s Green Bank, West Virginia. Just up the road from retirement isn’t Rocket science headquarters in Charlotte, North Carolina. It was confirmed at the Green Bait Telescope and the VLA out in New Mexico, but radio only tells us where the gas is. It took Hubble to look deep enough into the dark to prove there were no stars.

How did it get its name? Sadly , It’s not because astronomers were on Cloud nine with Joy, though they were. It was named sequentially . It was the ninth gas cloud identified on the outskirts of a nearby spiral Galaxy called Messier 94 M 94. The Cloud nine lives near M 94, and that’s in the Constellation.

Cannas Vena-tee-see , also known as the hunting dogs. And if you’re in the United States, you can see this constellation. It’s a northern constellation and visible during the spring and summer. However, and this is the rocket science, you can’t see Cloud nine. Even with a professional ground-based telescope, you won’t see it because it doesn’t emit visible light.

You need a radio telescope to quote, hear the hydrogen. You need a Hubble space telescope to confirm the nothingness where starch should be, but never formed even for professionals. It was a phantom until Hubble nailed it down.

You will find a multi wavelength image of Cloud nine in this week’s newsletter. Of course, you know where to sign up for that newsletter. It’s at retirement isn’t rocket science.com? Let me tell you a little bit about the image. It shows the location of Cloud nine, which is 14 million light years from Earth.

The diffuse magenta in that image represents the radio data. From the ground-based very large array. That’s the VLA array, showing the presence of the gas cloud. There’s a dash circle that marks the peak of that radio mission, which is where researchers focused their search for stars. Follow-up observations by the Hubble Space Telescopes.

Advanced camera for surveys found no stars within the cloud. The few objects that appear within its boundaries are background galaxies. Before Hubble’s observations, scientists could argue that Cloud nine is a faint dwarf Galaxy who Stars could not have been seen with ground-based telescopes due to the lack of sensitivity.

But Hubble’s advanced camera for surveys, shows that in reality. The failed galaxy contains no stars. That’s it for the retirement. Big picture this week. Keep looking up and keep planning ahead.

Conclusion

Dr. Chris Mullis, PhD, CFP®: So what’s your next step for putting this knowledge into action? Let me suggest two action items. Number one, define your go-go list. Write down the three most physically demanding things you want to do in retirement. Estimate the costs, and let’s see if you can front load those into the next three to five years.

And number two, check your biological clock. Go to the Society of Actuaries Longevity Illustrator website, plug in your details and look at the 90% probability and the 25% probability ages. Then look at your current financial plan. Does it still have fuel? If you hit that 25% mark,

And I said two actions, but I actually have a bonus. Third action. Review your Social Security Bridge strategy. Ask your advisor instead of taking social security now, can we, or should we use my IRA to fund my lifestyle today? So my guaranteed income is higher in the future. I challenge you to take one idea from today’s show and put it into practice this week to make your retirement even better. Thank you so much for joining me. Remember, you’ve done the hard work of saving. Now let’s do the smart work of planning.

Until next time, keep your eyes on the horizon. Enjoy the adventure. Launching your best retirement starts today.

Credits

Dr. Chris Mullis, PhD, CFP®: We thank the National Aeronautics and Space Administration for providing the radio communications between the spat shuttle astronauts and the flight controllers.

Disclaimer

This show is for informational and entertainment purposes only. It is not specific tax, legal or investment advice. Before considering acting on anything you hear in this show, first consult your own tax, legal or financial advisor.